This article was posted at noon EST on April 10 and subsequent events may have changed the specifics involved. The overall reality will likely be the same.

Donald John Trump decided to set the global economy on fire. There is no other way to really describe it. On the afternoon of April 2, Donald Trump announced from the White House that the United States would be imposing sweeping tariffs on most global trade with the US. A 10% across the board rate was applied to all countries to take effect on April 5 on the coming weekend. On top of that, separate additional rates were then applied on top of that to 60 different countries.1 The additional tariff rates were supposedly “reciprocal” to alleged trade economic policies by the target countries but subsequent independent analysis and statements from the Trump administration has revealed that they had no policy backing and instead were instead assessed based on how much those countries imported from the US compared to exports to the US, inherently assuming that all trade deficits run against the US were somehow the fruit of unjust policies.2 These additional rates on top of the 10% across the board rate ranged from a few extra percent to an extra 50%. Tariffs were not entirely unexpected by the global economy, but certainly tariffs this high were not expected. All at once, global trade was severely upended as the world’s second largest economy announced that it was essentially declaring a trade war with most of the rest of the planet. After the tariffs were announced business and govt leaders across the world went into sheer panic and began putting enormous pressure on the WH to retract the tariffs, with the Trump WH constantly issuing threats against other countries and the US congress over the issue.3 However, the prospect of severe economic damage seems to have forced Trump into a hasty retreat, with nearly all of the sky high “reciprocal” rates slated to be suspended for 90 days though the general 10% across the board tariff has gone into effect.4 However, as of writing, the Trump administration has still not listed out the countries considered to have reached out to Trump for negotiation and therefore eligible for the pause. Yet even the China tariffs may not fully stick in the end, as Trump publicly floated granting exemptions to US companies on his whims.5 Nevertheless, the global trading system and with it the globalized economy came perilously close to a complete immediate breakdown, and it is likely not be out of the woods yet.

A Big Book of Dumb Ideas

The actual intial reasoning behind this policy was relatively unclear from administration statements. The Trump administration first time around was not known for promoting a consistent and clearly articulated reasoning behind its policy, and round 2 is no different. Prior to the actual policy rollout, multiple lines of reasoning were advanced for a big tariff push. Replacing income taxes with tariffs, reindustralizing the US, pushing down interest rates to get an easier refinance of the US govts massive debt, etc. Multiple high level officials in the Trump administration have since the rollout pushed profoundly different messaging on the ultimate objectives behind this tariff policy. Anti trade radicals like presidential advisor Peter Navarro have viewed the tariffs as an end in themselves, rejected concessions, and have instead held the line that all trade imbalances against the US must be brought to an end.6 Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent have promoted the idea of using this to reshore production in the US, calling for goods to be made in US factories with US workers (including fired federal white collar workers?) while using tariffs as a tool towards renegotiating trade deals to favor the US by dumping poor quality US goods on other countries despite their health and safety standards.7 DOGE head Elon Musk has stated that the goal should be total free trade, with himself specifically speaking out against tariffs in general and in favor of using this to reach a total free trade agreement with the EU. There has also been open feuding between some of Trump’s staff on this issue.8 White House Council of Economic Advisors Chair Scott Miran presented multiple options which covered pretty much all previously listed options as well as adding more submission to US military diktat and an outright financial extortion of demanding direct cash payments to the US Treasury.9 Trump himself has said publicly or has been reported as saying privately all sorts of things since the initial announcement, the overall variety of which has resulted in Trump endorsing pretty much all of these goals at various points including 2 contradictory ones in the same sentence.10 All the Trump officials have been constantly demanding that other countries refrain from retaliating and standing up for themselves. Treasury Secretary and utter China ignoramus Bessent seems to have seized control of the narrative at the WH within the past day or two, and is now reframing the previous near economic collapse and total failure to accomplish any of the initial goals as a big campaign to screw over China.11 Trump himself however has contradicted this attempt at ass covering by admitting he pulled back in the face of widespread economic panic.12

A Crashing Market

The tariff announcement immediately caused a wave of panic in markets and national capitals across the world. Stock and commodity prices slumped considerably as businesses and investors suddenly anticipated a massive global recession.13 Major financial institutions like hedge funds faced serious challenges from the sudden and precipitous drop in values.14 However, yields on US Treasury 10 year notes crept upward at the same time, which is the opposite of what is supposed to normally happen in these circumstances, as crisis should induce a mass fleeing into safer US treasuries which then drops treasury yields.15 The instability and trade war in the US may be inducing investors to price in a rate hike as form of instability insurance, and there is also the possibility of sales of treasuries to cover unexpected expenses. It is now known that Japan, a US satellite and the largest overseas holder of US debt, was selling off a large volume of treasuries and was at responsible for a signficant share of the rate spike the night of April 8.16 Japan in so doing effectively forced the US to back off on this entire policy, something that many analysts had expected if it were to come at all from a unfriendly country like China. On April 9, the sudden announcement of the 90 day extension on at least some reciprocal tariffs caused stock markets across the world to rebound and treasury rates to drop. On April 10 the US numbers started moving in the wrong direction again with stocks falling and bonds spiking, as the euphoria from the delay was supplanted by realization that the US trade war with China was still going forward.17 In the wider US economy, most businesses are still bracing for impact as existing stockpiles of Chinese goods dry up over the coming weeks and months with no immediate prospect of restocking, and in China businesses have ceased any new shipments towards the US and have begun replanning for other markets as well as potential pass throughs to the US.18

Wheeler Dealer Dumber

Governments around the world immediately began scrambling to formulate a response. Some have chosen to offer concessions to the US. Countries like Vietnam have offered tariff free trade for US exports to their countries, though those tariffs were typically already fairly low thanks to previous trade agreements and adherence to WTO and GATT standards. However, in at least some cases these concessions have been outright rejected, with demands instead being presented for overall reductions in exports and the purchase of more low quality overpriced US goods of various kinds.19 For others, their supplication have been more warmly received, with Japanese PM Ishiba seemingly having positive conversations with Trump.20 Other countries are choosing to begin retaliatory actions. The European Union has begun assembling a list of US goods to enact tariffs upon in retaliation for US tariffs, though they have not yet released the full list nor have they prepared to enact an across the board tariff.21 Still others are calling for and preparing multilateral actions against these tariffs, like Malaysia calling for a united ASEAN response to Trump.22 Virtually all countries, including US allies, have been deeply disturbed by these US attacks on the global free trade system it itself built, and regardless of how they are choosing to directly approach the US on this question in this moment, they all have begun quietly looking for trade diversification and other ways to shield themselves from this and other US attacks in the future.23 However, the ultimate target of this entire situation is China.

The China Hit

The tariffs have primarily become a way to beat down China, not just in their direct exports to the US, but in other areas as well. Earlier this year, the Trump administration imposed a across the board 20% tariff on Chinese goods at the same time as it imposed similar tariffs on Canada and Mexico. Though the Trump administration ultimately at least partially backed down on the NAFTA partner tariffs, the Chinese tariffs went ahead as planned.24 With the latest round of tariffs, Trump applied an additional 34% on top of the previous 20%, bringing the total tariff rate to 54%.25 After Chinese retaliation for the 34%, Trump then imposed an additional 50% tariff on Chinese goods, bringing the total to a 104% tariff.26 After another round of Chinese retaliation Trump then announced a further hike of 21% to a total rate of 125%.27 Later another 20% hike was announced bringing the total to 145%. In addition to the overall tariff rates, the Trump administration is also preparing to take other economic measures against China.

The administration is preparing a system of massive penalties designed to promote US shipbuilding and hobble Chinese shipping, with massive fees for docking Chinese built ships in US ports. After massive shipping industry pushback however the administration is revising downwards its planned fee structure from the completely crippling plan of potentially millions of dollars in fees per docking to something somewhat less crippling and weighted based on ship size and the company in question. On top of the fees, there will be official mandates to require a certain percentage of US exports to travel on US made and US crewed ships within a few years.28 Such measures are essentially a global version of the US Jones Act, which requires vessels traveling between US ports to be US made and crewed. This act has not been remotely successful at promoting US shipbuilding, and there is little reason to expect a global version would do much better. China currently builds half the world’s commercial shipping, and is unlikely to lose this dominant position even with these measures.29

In addition, the Trump administration is likely to use the tariffs to force pro-US anti-China concessions from countries around the world. For example, Vietnam has already been pressured into a statement that it will buy more US arms, thereby tying its military to the US to some extent and against China.30 The US may end up demanding a variety of other anti-China concessions in other cases, ranging from US basing rights to pressure on Chinese companies to cutting trade with China etc. The tariffs in and of themselves have become simply a weapon rather than the end in and of itself, like when Trump threatened to seize the Panama Canal but mostly backed off after Panama backed away from the BRI and pressured a Hong Kong firm to sell its port stakes in the country(though the deal is currently suspended thanks to Chinese govt pressure on the firm in question).31 The Trump administration is busy further saber rattling against China on economic issues, blithely dismissing Chinese retaliatory actions and threatening more measures against China.32 The notion that this all ultimately became targeted towards China was solidified after Trump announced that the tariffs on others would be paused for 90 days, but tariffs on China would hike even higher.33 Trump officials have also been talking up how this has weakened China’s position and “exposed” it, as if one were to hit someone on the head with a hammer and when they were retaliated against claimed they were the put upon party.34 In any case, the massive tariffs now in effect between Washington and Beijing amount to being effectively an embargo between the two countries, as there are very few if any goods that can be exported or imported profitably with either a 84 or 125 percent surcharge.

The Chinese People Stand Up

China, the primary focus of US anger and main target of most US foreign policy nowadays, decided not to take all this lying down. During the first round of Mexico, Canada, and China tariffs, China retaliated with targeted tariffs at certain US imports, decreased purchases of US agricultural products, and measures to pressure US companies like Google as well as Chinese export restrictions against the US.35 For the “Liberation Day” tariffs Beijing decided to give the US both barrels, immediately placing 34% matching tariffs on all US imports, further measures pressuring US companies like Dupont, and export restrictions on more Chinese rare earth minerals which are crucial for technology production as well as export bans for key US companies.36 Notably, China’s export restrictions on rare earths are of a global nature, suggesting that China plans to leverage its supermajority dominance in this key sector(and perhaps in other sectors in the future) to put the squeeze on any technological production more advanced than a toaster in the US or perhaps even going towards the US.37 Since Trump’s retaliation for the retaliation, China has further retaliated with an additional 50% tariff on US goods, bringing its total to 84% across the board on all US goods.38 Additional Chinese retaliation against the US has taken the form of suspension of some joint drug control efforts, banning US movie imports, investigating US corporate IP, restrictions on US services, investigations into US trade dumping, etc.39 Chinese state investors have intervened to help defend the Chinese stock market, buying stock and expressing confidence in the market which has successfully stanched an earlier collapse.40 China has also been letting the valuation of the RMB slide a bit to signal it is ready for a currency fight.

China has also sought to rally the global community to its side in defense of free trade and the interconnected global economy, denounced concessions to the US as appeasement that will only invite more bullying, and has filed suit in the WTO.41 Chinese officials have been meeting and calling with their counterparts across the world to discuss deeper cooperation, reiterate Chinese commitment to free trade and competition, and calling upon leaders in Vietnam, the EU, and others.42 Chinese economic planning for this year already anticipated that the international situation could provide serious headwinds for Chinese growth, and China even prior to all of this began implementing a major stimulus program to support the economy and domestic consumption.43 Chinese officials and media have expressed strong confidence in China’s ability to weather the storm, and have pledged to fight to the end.44 China retains plenty of freedom of action and options in terms of potential measures both to retaliate further against the US and support economic growth in this challenging environment.

Risks-US

The US economy was already facing serious headwinds even before all this happened, thanks to slumping commercial real estate, consumer demand, turmoil in govt spending and operations, and a whole mess of other problems.45 These issues already caused substantial economic pessimism in the US going forward, and way before this current crop of issues, recession risk assessments from major institutions like Goldman Sachs and the Atlanta Federal Reserve were ticking up.46 The US economy has also not been remotely adequately prepared for changes Trump has imposed even before the tariffs, and the tariffs themselves, especially of this size and scope, were certainly unplanned for. The “derisking” and “reshoring” crap promoted by Biden and Trump 1 to move production away from China has been mostly a failure, as industry in other countries consistently proved unable to match Chinese quality and economies of scale, with virtually all industry that was moved still overwhelmingly dependent on Chinese production for components and the like, and in some cases said industry were just an outright pass through for Made in China goods.47 The US is overwhelmingly dependent on physical goods imports from China for all stages of production and sale, ranging from raw materials to component parts to machinery to finished goods. Already reports are flooding in across social media and the mainstream press about US firms, including many manufacturers, under threat thanks to the sudden and massive tariff surcharge, with companies canceling or reconsidering overtime, expansions, and other business activities, and many firms have even said they will have no choice but to shut down.48 Trump has floated granting exemptions, but most businesses impacted by this policy will not have access to the WH to plead their case, and a system of arbitrary exemptions based on Trump’s personal and political predelictions will only further damage the US reputation as a friendly and impartial business environment.

The modern US social contract is primarily predicated on continuous access to a vast flow of cheap consumer goods, a flow endangered by the tariffs. Such a breaking of promises implicit and explicit will lead to substantial political backlash and potentially generate unrest. The disruption of the central state apparatus through the Muskite DOGE has reduced the US’s state capacity in general and has undermined crucial aspects of US development, especially in science and technology.49 The US strength lies more in its control of global finance through the dollar system, and its network of satellite states, though both of those are undoubtedly being undermined by US aggression in the past few years ranging from the seizure of Russian sovereign central bank reserves, to threats to annex Greenland, to this whole tariff explosion, as countries become aware of the dangers of being dependent on the US. Most countries are already looking for ways to try and diversify their international options.

The US, at least for the moment, is putting on a good show of its confidence, with Bessent and other officials laughing off Chinese retaliation and floating further actions to twist the knife.50 This confidence is not exactly the most believable, given that the China screwing plan only really arose form the Trump administration after the complete faceplant on other goals. Under the current circumstances, the US rallying to maintain even current measures is likely to be difficult in the medium to long term, much less enacting new ones especially multilateral ones. The US faces increasingly serious economic problems of its own, with no clear exit strategy, and has offended and alienated much of the planet by this point. In the coming months, to cover for US failure and mounting economic pain from this disastrous policy, the US is likely to resort to its oldest and most reliable method, a campaign of racist xenophobia. Let no one distract from the fact that this idiotic and self hurting policy was, like most US failures, a war of choice by the US leadership.

Risks-China

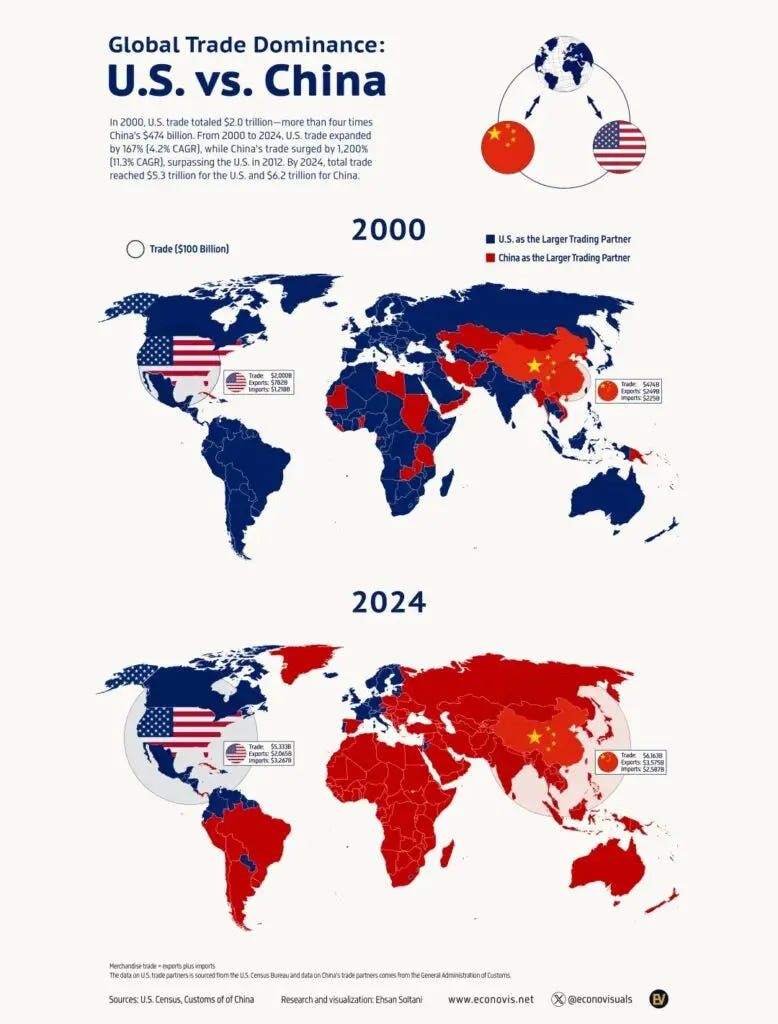

By contrast, China has spent the past years preparing itself for an economic showdown with the US, building out infrastructure and trade relations with the rest of the world to drop its dependency on exports to the US, with US trade remaining stable while exports to the rest of the world have risen 80%. China has enhanced domestic consumption to reduce export dependence in general, with exports as percentage of Chinese GDP dropping from a high of more than 35% to less than 20% and continuing on a downward trend.51 With these changes US trade with China is now less than 10% of Chinese exports and less than 2% of GDP overall.52 China is the largest trading partner for the overwhelming majority of countries, including the fast growing emerging markets.

Chinese economic planners this year had also already anticipated major international headwinds and planned a major domestic stimulus package, aimed at keeping production humming and promoting consumer purchases.53 These efforts have met with success so far, as shown in events like Chinese consumers rushing to stores to take advantage of state rebates on domestically manufacturing big consumer purchases like cell phones and washing machines.54 The controlled deflation of the previously enormous Chinese real estate bubble has not only provided the opportunity to cheapen housing for Chinese workers lower on the totem pole, but removed a major economic vulnerability from shattering under pressure in an uncontrolled manner.55 China has also successfully worked to drive up productivity and expand into new product areas, reducing the already small need for imports of all kinds of finished goods, as well as enhancing energy self sufficiency and the environment through EV and green energy adoption.56 Chinese technical and scientific development has ensured that China will lead in most key innovative areas for the coming decades.

A drop in export earnings is far from ideal for China, but something it will survive and likely ultimately shrug off. China’s strong confidence can be seen in the statements by both officialdom and Chinese media, referring to the US as a “tariff-wielding barbarian”, pledging to “fight to the end”, denouncing concessions as appeasement, and maintaining sanguine confidence in the economic response being rolled out.57 China has both the economic capacity and political willingness to take serious measures to blunt the impacts of the crisis and to reduce future risk, and the public in China rightly sees their country as being under attack and have therefore rallied to the flag.

Consequences and Exits

This economic fight is likely to have utterly catastrophic global consequences if it persists for any serious period of time. Though the tariffs are currently paused on at least some countries, there is no inherent guarantee that things will stay that way. If the general tariffs end up being implemented at any point, US tariff rates will be higher than that of the infamous Smoot-Hawley tariff widely blamed for grinding international trade to a halt during the Great Depression and worsening an already catastrophic situation.58 A trade war of all against all could easily result, halting much of global trade and triggering massive downturns and realignments as countries and businesses scramble for cover. There is also the risk that the Trump administration considers some or even most of the countries on the list to have not been sufficiently groveling and decide to impose tariffs on them anyway. Even if the delays on the other tariffs are both widespread and kept up going forward, just the US-China tariffs is all but certain to create at least some degree of economic crisis at least in those two countries. Given that they hold position as second largest and largest economies on earth respectively, such problems could spread like a contagion from their origin and crash the global economy anyway. Instability caused by the fear of the big tariffs returning will also not be a good thing for the global economy. The new baseline universal US tariff rate of 10%, confirmed by the WH, is in itself a serious trade policy change that will have major impacts on the US, and indeed the global economy writ large. The world’s two largest economies are now playing a very dangerous game of chicken. The only real way out is for both countries to quietly agree to a choreographed and managed mutual climbdown to deflate the building crisis.

Note: Since the publication of this piece on April 10, the US has already begun retreating from its bellicose policies almost as fast as they were announced, with announcement of full exemptions from “reciprocal” tariffs for advanced consumer electronics like computers and smartphones. China meanwhile has exempted tariffs on semiconductor imports from the US if the chips themselves are not actually made in the US but are instead outsourced like with TSMC. US-made chips will be subject to full tariffs even if assembly or packaging is done on them in China.59

Pichee, Aimee. “Trump Reveals These 2 New Types of Tariffs on What He Calls ‘Liberation Day,’ April 2.” CBS News, April 2, 2025. https://www.cbsnews.com/news/liberation-day-trump-tariffs-explained/.

Surowiecki, James. “This Is Truly Amazing. The Deputy White House Press Secretary Is Claiming That I’m Wrong...” Twitter, April 3, 2025. https://x.com/jamessurowiecki/status/1907657860793696281?s=46.

Isenstadt, Alex, and Hans Nichols. “Trump Issues Veto Threat on Tariff Bill Backed by Senate Republicans.” Axios, April 7, 2025. https://www.axios.com/2025/04/07/trump-veto-tariff-bill-grassley.

Navarro, Peter. “Donald Trump’s Tariffs Will Fix a Broken System.” Financial Times, April 7, 2025. https://www.ft.com/content/f313eea9-bd4f-4866-8123-a850938163be.

Trump, Donald. “Based on the Lack of Respect That China Has Shown to the World’s Markets,...” Twitter, April 9, 2025. https://x.com/TrumpDailyPosts/status/1910020971978797337.

Merritt, Sawyer. “NEWS: Trump Just Said That He Will Be Looking at Exempting Some US Companies from Tariffs.” Twitter, April 9, 2025. https://x.com/SawyerMerritt/status/1910051974839427139.

Navarro, Peter. “Donald Trump’s Tariffs Will Fix a Broken System.” Financial Times, April 7, 2025. https://www.ft.com/content/f313eea9-bd4f-4866-8123-a850938163be.

Pound, Jesse. “Peter Navarro Says Vietnam’s 0% Tariff Offer Is Not Enough: ‘It’s the Nontariff Cheating That Matters.’” CNBC, April 7, 2025. https://www.cnbc.com/amp/2025/04/07/peter-navarro-says-vietnams-0percent-tariff-offer-is-not-enough-its-the-non-tariff-cheating-that-matters.html.

Rupar, Aaron. “Lutnick: "The Army of Millions and Millions of Human Beings Screwing in Little Screws to Make iPhones..” Twitter, April 6, 2025. https://x.com/atrupar/status/1876675689744646527.

Rupar, Aaron. “LUTNICK: Europe Won’t Let Us Sell Beef...” Twitter, April 3, 2025. https://x.com/atrupar/status/1907604332079394838.

Liptak, Kevin, Alayna Treene, and Pamela Brown. “Bessent’s Mar-a-Lago Tariff Message to Trump: Zero in on the Endgame.” CNN, April 8, 2025. https://www.cnn.com/2025/04/07/politics/trump-bessent-tariff-message/index.html.

Pager, Tyler. “Elon Musk Calls Peter Navarro a ‘Moron’ in Escalating Tariff Fight.” New York Times, April 8, 2025. https://www.nytimes.com/2025/04/08/us/politics/musk-navarro-tariffs-fight.html.

Miran, Steve. “CEA Chairman Steve Miran Hudson Institute Event Remarks.” The White House, April 7, 2025. https://www.whitehouse.gov/briefings-statements/2025/04/cea-chairman-steve-miran-hudson-institute-event-remarks/.

Rashid, Hafiz. “Cognitive Decline? Trump Calls for Open Borders in Rant on Tariffs.” The New Republic, April 7, 2025. https://newrepublic.com/post/193702/trump-open-borders-tariffs.

Wiesenthal, Joe. “Bessent Says Trump Has Successfully Goaded China into Revealing That It’s a Bad Actor.” Twitter, April 9, 2025.

Rein, Shaun. “It Just Hit Me. I Advised Scott Bessent...” https://x.com/shaunrein/status/1909992240413356456, April 9, 2025.

Weisenthal, Joe. “WHAT COMES NEXT AFTER ‘BLINK WEDNESDAY.’” Twitter, April 10, 2025. https://x.com/thestalwart/status/1910338938289483959?s=46&t=XcTQEAmVq56cJu9IKvdPKg.

“Stock Markets Today.” Twitter, April 7, 2025. https://x.com/spectatorindex/status/1909331368682963383.

“Commodity Roundup: Oil Prices at 4-Year Low; Higher Tariffs Likely to Crimp Demand for US Soybeans.” MSN, April 8, 2025. https://www.msn.com/en-us/money/markets/commodity-roundup-oil-prices-at-4-year-low-higher-tariffs-likely-to-crimp-demand-for-us-soybeans/ar-AA1CvJUa.

Agnew, Harriet, Joshua Franklin, and Costas Mourselas. “Hedge Funds Hit with Steepest Margin Calls since 2020 Covid Crisis.” Financial Times, April 4, 2025. https://www.ft.com/content/8ba439ec-297c-4372-ba45-37e9d7fd1771.

Kobeissi, Adam. “Talk about a Shift in Sentiment:” Twitter, April 8, 2025. https://x.com/TKL_Adam/status/1894018353187971493.

Gasparino, Charles. “Why Trump Decided to Take the Win and Paused Tariff War.” New York Post, April 9, 2025. https://nypost.com/2025/04/09/business/why-trump-decided-to-take-the-win-and-paused-tariff-war/.

Bird, Mike. “S&P 500 down 2%, ...” Twitter, April 10, 2025. https://x.com/Birdyword/status/1910318359339466826.

Gasparino, Charles. “Why Trump Decided to Take the Win and Paused Tariff War.” New York Post, April 9, 2025. https://nypost.com/2025/04/09/business/why-trump-decided-to-take-the-win-and-paused-tariff-war/.

Bernhard. “Trump’s Tariff Wars Will Hurt U.S.. the Most.” Moon of Alabama, April 9, 2025. https://www.moonofalabama.org/2025/03/trumps-tariff-wars-will-hurt-us-the-most.html.

Pound, Jesse. “Peter Navarro Says Vietnam’s 0% Tariff Offer Is Not Enough: ‘It’s the Nontariff Cheating That Matters.’” CNBC, April 7, 2025. https://www.cnbc.com/amp/2025/04/07/peter-navarro-says-vietnams-0percent-tariff-offer-is-not-enough-its-the-non-tariff-cheating-that-matters.html.

“Japan’s Prime Minister Speaks with U.S. President by Phone over Tariffs.” Xinhua, April 8, 2025. https://english.news.cn/20250408/40e28cce89ec4354bd96b38e2d21ab91/c.html.

Reid, Jenni, and Sophie Kiderlin. “European Union Approves First Set of Retaliatory Tariffs on U.S. Imports.” CNBC, April 9, 2025. https://www.cnbc.com/2025/04/09/european-union-approves-first-set-of-retaliatory-tariffs-on-us-imports.html.

“Malaysian PM: Southeast Asia Must ‘stand Firm’ against U.S. Tariffs.” CGTN, April 7, 2025. https://news.cgtn.com/news/2025-04-07/Malaysian-PM-Southeast-Asia-must-stand-firm-against-U-S-tariffs-1CnAtffBbry/p.html.

Kyekyeku, Kofi Oppong. “Lesotho Hit with Harshest U.S. Tariffs - and This Is How It Reacted.” Face2Face Africa, April 7, 2025. https://face2faceafrica.com/article/lesotho-hit-with-harshest-u-s-tariffs-and-this-is-how-it-reacted.

Smalls, Boston. “Singapore Prime Minister Lawrence Wong.” Twitter, April 7, 2025. https://x.com/smalls2672/status/1899883533327290493.

Stein, Jeff, and David Lynch. “Trump Aides Prep New Tariffs on Imports Worth Trillions for ‘Liberation Day.’” Washington Post, March 19, 2025. https://www.washingtonpost.com/business/2025/03/19/trump-tariffs-imports-liberation-day/.

“Trump’s Tariffs Launch a Global Trade War with No Clear off-Ramp: Live Updates.” CNBC, April 9, 2025. https://www.cnbc.com/2025/04/09/trump-tariffs-live-updates.html.

“Trump’s Tariffs Launch a Global Trade War with No Clear off-Ramp: Live Updates.” CNBC, April 9, 2025. https://www.cnbc.com/2025/04/09/trump-tariffs-live-updates.html.

Trump, Donald. “Based on the Lack of Respect That China Has Shown to the World’s Markets,...” Twitter, April 9, 2025. https://x.com/TrumpDailyPosts/status/1910020971978797337.

Petersen, Ryan. “On April 17th the U.S. Trade Representative’s Office Is Expected to Impose Fees...” Twitter, April 7, 2025. https://x.com/typesfast/status/1909362292367802840.

Saul, Jonathan, and Renee Maltezou. “Exclusive: US Considers Adjusting Port Fee Plan for Chinese Vessels after Pushback, Sources Say.” Reuters, April 9, 2025. https://www.reuters.com/world/us-considers-adjusting-port-fee-plan-chinese-vessels-after-pushback-sources-say-2025-04-08/.

Tang, Didi. “China’s Shipbuilding Dominance Poses Economic and National Security Risks for the US, a Report Says.” AP News, March 11, 2025. https://apnews.com/article/shipbuilding-china-united-states-trump-c995b06f35041e4ca1928e40f53adec5.

Vu, Khanh. “Vietnam to Buy US Defence, Security Products to Tackle Trade Gap.” Reuters, April 8, 2025. https://www.reuters.com/world/asia-pacific/vietnam-says-buy-american-defence-security-products-trump-tariffs-loom-2025-04-08/.

“China Halts Panama Port Sale to Blackrock.” gCaptain, March 28, 2025. https://gcaptain.com/china-halts-panama-port-sale-to-blackrock/.

“BREAKING: US Treasury Secretary Bessent Says Regarding China...” Twitter, April 9, 2025. https://x.com/spectatorindex/status/1907537812049854543.

Trump, Donald. “Based on the Lack of Respect That China Has Shown to the World’s Markets,...” Twitter, April 9, 2025. https://x.com/TrumpDailyPosts/status/1910020971978797337.

“BREAKING: US Treasury Secretary Bessent Says Regarding China...” Twitter, April 9, 2025. https://x.com/spectatorindex/status/1907537812049854543.

Panda, Shanghai. “Retaliation from China -.” Twitter, February 4, 2025. https://x.com/thinking_panda/status/1906556958016168208.

“China Hits Back at US with 34% Extra Tariffs, Lawsuit at WTO Following Its ‘Reciprocal Tariffs.’” Global Times, April 4, 2025. https://www.globaltimes.cn/page/202504/1331476.shtml.

Li. “This Is an Important Detail in China’s Export Control on Rare Earths: It’s Not Just against the US, It’s Global...” Twitter, April 7, 2025. https://x.com/missquanyi18/status/1909367255085072425?t=XcTQEAmVq56cJu9IKvdPKg.

“国务院关税税则委员会公布公告调整对原产于美国的进口商品加征关税措施.” 中华人民共和国财政部, April 9, 2025. https://gss.mof.gov.cn/gzdt/zhengcejiedu/202504/t20250409_3961685.htm.

“Source: China Poised to Unveil Six Major Countermeasures in Response to U.S. Tariff Threats (Mktnews.Com).” MKT News - market news for traders, April 8, 2025. https://mktnews.com/flashDetail.html?id=0196139a-b385-7cca-bd45-6e20eb2e4625.

“China Hits Back at US with 34% Extra Tariffs, Lawsuit at WTO Following Its ‘Reciprocal Tariffs.’” Global Times, April 4, 2025. https://www.globaltimes.cn/page/202504/1331476.shtml.

“China’s Central Bank on Tuesday Vowed to Resolutely Safeguard the Stable Operation of the Country’s Capital Market.” Twitter, April 7, 2025. https://x.com/PDChina/status/1909424707411103878.

“Commentary: Appeasing Washington Will Lead to More Economic Bullying.” People’s Daily Online, April 2, 2025. http://en.people.cn/n3/2025/0402/c90000-20297322.html.

“Spanish Prime Minister Sánchez to Visit China.” 中华人民共和国外交部, April 8, 2025. https://www.mfa.gov.cn/eng/xw/wsrc/202504/t20250408_11589970.html.

wrenevans. “China Is Ready to Import High-Quality Vietnamese Exports, Including Agricultural Products. .” Twitter, April 7, 2025. https://x.com/wrenevans217208/status/1909272489823449398?t=g38s8F3ycmFoAh62URnxHw.

“Chinese Premier Li Qiang Held a Phone Call with European Commission President Ursula von Der Leyen on Tuesday.” Twitter, April 8, 2025. https://x.com/globaltimesnews/status/1909592316517794249?t=XcTQEAmVq56cJu9IKvdPKg.

“中共中央办公厅 国务院办公厅印发《提振消费专项行动方案》.” 中共中央办公厅 国务院办公厅印发《提振消费专项行动方案》_中央有关文件_中国政府网, March 16, 2025. https://www.gov.cn/zhengce/202503/content_7013808.htm.

“Chinese Government’s Position on Opposing U.S. Abuse of Tariffs.” Ministry of Foreign Affairs People’s Republic of China, April 5, 2025. https://www.mfa.gov.cn/eng/xw/zyxw/202504/t20250406_11589042.html.

“人民日报评论员:集中精力办好自己的事 增强有效应对美关税冲击的信心.” People’s Daily, April 6, 2025. http://opinion.people.com.cn/n1/2025/0406/c1003-40454209.html.

Pesek, William. “Trump’s Tariff Onslaught Headed for Self-Defeating Recession.” Asia Times, April 4, 2025. https://asiatimes.com/2025/04/trumps-tariff-onslaught-headed-for-self-defeating-recession/.

Cox, Jeff. “The First Quarter Is on Track for Negative GDP Growth, Atlanta Fed Indicator Says.” CNBC, February 28, 2025. https://www.cnbc.com/2025/02/28/the-first-quarter-is-on-track-for-negative-gdp-growth-atlanta-fed-indicator-says-.html.

Jose, Joel. “Goldman Raises Odds of US Recession to 35% .” Reuters, March 31, 2025. https://www.reuters.com/markets/us/goldman-sachs-expects-us-fed-deliver-three-rate-cuts-2025-2025-03-31/.

Dayen, David. “The Economic Consequences of the Tariff War.” The American Prospect, April 9, 2025. https://prospect.org/economy/2025-04-09-economic-consequences-tariff-war/.

Cameron, Hugh. “Pandemonium Breaks Out Among Small Businesses Over Trump Tariffs.” MSN, April 9, 2025. https://www.msn.com/en-us/money/smallbusiness/pandemonium-breaks-out-among-small-businesses-over-trump-tariffs/ar-AA1CBNtP.

Barr, Annabel. “As Tariffs Hit, Manufacturers Brace for Impact.” NAM, April 2, 2025. https://nam.org/as-tariffs-hit-manufacturers-brace-for-impact-33695/?stream=series-press-releases.

Bade, Rachel. “Trump Tells Inner Circle That Musk Will Leave Soon.” Politico, April 2, 2025. https://www.politico.com/news/magazine/2025/04/02/trump-musk-leaving-political-liability-00265784.

“BREAKING: US Treasury Secretary Bessent Says Regarding China...” Twitter, April 9, 2025. https://x.com/spectatorindex/status/1907537812049854543.

Liptak, Kevin, Alayna Treene, and Pamela Brown. “Bessent’s Mar-a-Lago Tariff Message to Trump: Zero in on the Endgame.” CNN, April 8, 2025. https://www.cnn.com/2025/04/07/politics/trump-bessent-tariff-message/index.html.

Goldman, David P. “The Great Re-Shoring Charade.” Asia Times, April 6, 2023. https://asiatimes.com/2023/04/the-great-re-shoring-charade/.

“Exports of Goods and Services (% of GDP) - China.” World Bank Open Data. Accessed April 9, 2025. https://data.worldbank.org/indicator/NE.EXP.GNFS.ZS?locations=CN&name_desc=false.

Hakimian, Spencer. “China’s Exports to the U.S. Are Flat over the Past *13 Years*. .” Twitter, April 6, 2025. https://x.com/spencerhakimian/status/1909063446387192148?t=XcTQEAmVq56cJu9IKvdPKg.

“中共中央办公厅 国务院办公厅印发《提振消费专项行动方案》.” 中共中央办公厅 国务院办公厅印发《提振消费专项行动方案》_中央有关文件_中国政府网, March 16, 2025. https://www.gov.cn/zhengce/202503/content_7013808.htm.

“China Ramps up Stimulus to Guard Economy from Changes ‘unseen in a Century’ .” Reuters, March 5, 2025. https://www.reuters.com/world/china/chinas-parliament-meets-shield-economy-us-tariff-salvos-2025-03-04/.

Lee, Peter. “Ah, Consumer Stimmy and Investments Directed...” Twitter, October 12, 2023. https://x.com/chinahand/status/1712352498462384580.

“China’s Economic Growth Target Supported by Solid Foundation, Offers Global Opportunities in Green Technology and Trade.” Global Times, April 2, 2025. https://www.globaltimes.cn/page/202504/1331434.shtml.

“Letters: America’s Tariff Intimidation Is the Act of a Modern-Day Barbarian.” South China Morning Post, April 9, 2025. https://www.scmp.com/opinion/letters/article/3305866/americas-tariff-intimidation-act-modern-day-barbarian.

“Commentary: Appeasing Washington Will Lead to More Economic Bullying.” People’s Daily Online, April 2, 2025. http://en.people.cn/n3/2025/0402/c90000-20297322.html.

“Chinese Government’s Position on Opposing U.S. Abuse of Tariffs.” Ministry of Foreign Affairs People’s Republic of China, April 5, 2025. https://www.mfa.gov.cn/eng/xw/zyxw/202504/t20250406_11589042.html.

“China’s Economic Growth Target Supported by Solid Foundation, Offers Global Opportunities in Green Technology and Trade.” Global Times, April 2, 2025. https://www.globaltimes.cn/page/202504/1331434.shtml.

Wu, Debby, Josh Wingrove, and Shawn Donnan. “Trump Exempts Phones, Computers, Chips from ‘Reciprocal’ Tariffs .” Bloomberg, April 12, 2025. https://www.bloomberg.com/news/articles/2025-04-12/trump-exempts-phones-computers-chips-from-reciprocal-tariffs.

EconoTimes. “China Exempts U.S. Outsourced Chips from Tariffs, Favoring TSMC-Made Products.” EconoTimes, April 11, 2025. https://www.econotimes.com/China-Exempts-US-Outsourced-Chips-from-Tariffs-Favoring-TSMC-Made-Products-1707363.